Your personal identification (ID) is just that, personal. Unfortunately, in today’s world, your ID could get compromised with everyday activities such as ordering food online or signing up for a new music service. To observe Data Privacy Day, the AICPA® Financial Literacy Commission encourages you to take a few steps to find out where your ID has been — and make sure it’s safe and secure.

Your personal identification (ID) is just that, personal. Unfortunately, in today’s world, your ID could get compromised with everyday activities such as ordering food online or signing up for a new music service. To observe Data Privacy Day, the AICPA® Financial Literacy Commission encourages you to take a few steps to find out where your ID has been — and make sure it’s safe and secure.

It might surprise you to learn that most Americans feel that it’s inevitable that their information will be stolen. Three in five (60%) say that it’s likely that ID theft will lead to a financial loss in the next year. The good news is that they recognize this as a real threat. The bad news is that many still don’t incorporate measures to protect their financial information, even with a significant increase in their online shopping since the start of the pandemic. This is all according to a recent AICPA survey The Harris Poll conducted on behalf of the American Institute of CPAs® (AICPA).

Taking a few proactive steps can go a long way to help mitigate the ID theft threat. To avoid the financial fallout of someone posing as you, the AICPA’s 360 Degrees of Financial Literacy program encourages Americans to use Data Privacy Day to learn about the threat and the steps that will help protect them.

Why is protecting your personal and financial information important? And what can YOU do to prevent your data from falling into the wrong hands? To learn these answers and more, Matt Rosenberg, CPA/PFS, a member of the AICPA’s National CPA Financial Literacy Commission, spoke with AICPA Insights about the AICPA survey results and how to protect your information from scammers.

Did anything from the survey concern you? Why does this matter now more than ever?

Matt Rosenberg: The fact that more than half of Americans have increased their online shopping (56%) since the start of the pandemic shouldn’t come as a surprise, however, it is concerning that less than half of online shoppers (45%) regularly check their statements to ensure charges are recorded correctly. This is not only important for preventing fraud but also catching mistakes. I’d hate for $200 to be taken from my account for a cup of coffee instead of $2.00, simply because the vendor misplaced a decimal and I never noticed it.

What are some of the risks for those who don’t take steps to protect their information?

MR: While credit card companies or banks may refund some fraudulent purchases, this isn’t a certainty, and most of the risks to identity theft are broader than a single transaction. Once a fraudster has access to your personal and financial information, they can be used to make recurring unauthorized purchases, open accounts and damage your credit. Bad credit makes it harder to obtain credit cards, favorable loan terms, lease a car, purchase a home or even pass a background check as part of a job application. The outcome can be a downward spiral of financial difficulty that will make a consumer’s life harder and more stressful. The increase in online shopping has created more opportunity for scammers. So now, more than ever, it’s important for consumers to pay attention. Many people who haven’t fallen victim to identity theft may not take it as seriously. However, the survey found that nearly one in five Americans (19%) suffered identity theft or attempted identity theft within the last year, showing that the issue is widespread.

How can Americans protect their IDs?

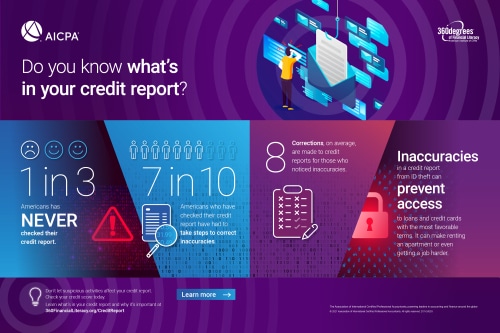

MR: First, people should be familiar with their credit report and score. Unfortunately, the survey found that one-third (33%) of Americans have never check their credit report. While regularly checking your credit can feel like a chore, credit agencies make it easier by allowing individuals to sign up to receive alerts anytime something changes their credit scores. Everyone should sign up for these alerts and make sure to look at it when one is received. Second, everyone should create an efficient password system and keep it confidential. Using the same password for all sites, or easily guessed passwords, is never a good idea. But using superfluous or elusive passwords that are different for every site often leads people to write them down and/or create lists that can be compromised. Having a password system that is both secure and manageable takes time and thought, but it’s the best way to prevent your identity from being compromised.

The AICPA has resources at 360FinancialLiteracy.org/SafeID to help Americans learn about the ways to protect their information and the steps to take if they become an ID theft victim. Share this valuable information with friends, family members and clients to help them protect their personal and financial information from fraudsters.

Association Staff

Related Stories

- To avoid tax surprises Americans should update their W-4

- Taxpayers are unaware of remote worker state tax liabilities

- 2021 busy season due dates can’t come soon enough

Originally published by AICPA.org